The ‘Age 67’ Rule: Why Retiring at 65 Could Cost You Thousands in 2026 (Social Security Update)

(Washington D.C.) — For decades, the “American Dream” of retirement had a specific number attached to it: Age 65. It was the golden age when you could hang up your work boots, grab your pension, and enjoy life.

But if you are planning to retire in 2026, you need to forget that number.

A quiet but massive shift in Social Security rules has fully taken effect, and it is catching many retirees off guard. If you were born in 1960 or later, your “Full Retirement Age” (FRA) is no longer 65 or 66. It is now officially 67.

Why is “67” trending right now? Because claiming benefits before this birthday doesn’t just mean getting paid early—it means taking a permanent pay cut.

Here is what you need to know about the “Age 67 Rule” before you file your paperwork.

1. The “1960” Cutoff: Are You Affected?

The Social Security Administration (SSA) has been gradually raising the retirement age for years. Now, the transition is complete.

- If you were born between 1943 and 1954, your full retirement age was 66.

- If you were born in 1960 or later, your full retirement age is 67.

This means if you turn 62 or 65 this year, the government considers you “early,” not “on time.”

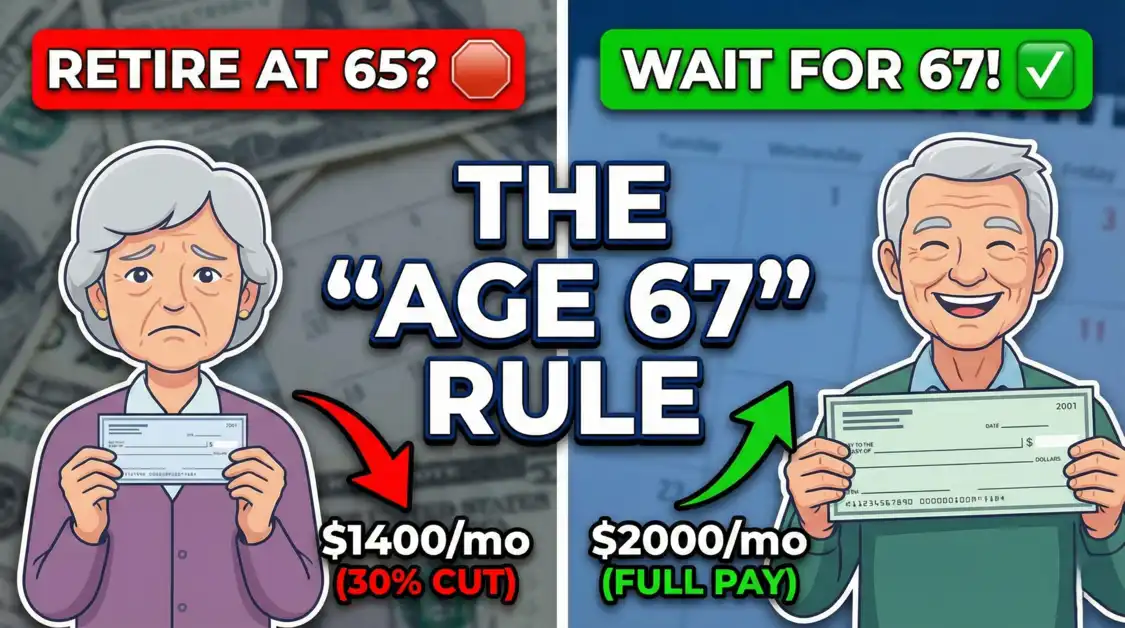

2. The Math: How Much Do You Lose by Claiming Early?

Let’s say your estimated full benefit is $2,000 a month. Many people think, “I’ll just take it at 62. I want the money now.” But the penalty is steeper than most realize.

- At Age 62 (Early): You get only 70% of your benefit.

- Result: Your check shrinks to $1,400. This cut is permanent. It does not go back up when you turn 67.

- At Age 67 (Full Age): You get 100% of your benefit.

- Result: You get the full $2,000.

- At Age 70 (Delayed): You get 124% of your benefit.

- Result: Your check grows to $2,480.

The Bottom Line: By waiting just five years (from 62 to 67), you essentially give yourself a massive raise that lasts for the rest of your life.

3. The “Medicare Gap” Trap

This is where people get confused. Even though your Social Security full age is 67, Medicare eligibility still starts at 65.

Do not make the mistake of waiting until 67 to sign up for health insurance. You must sign up for Medicare at 65 to avoid late penalties, even if you plan to delay your Social Security checks for two more years.

4. Will the Age Go Up to 69?

You might have seen rumors on social media about the retirement age rising to 69 or even 70. Currently, this is just a proposal debated by some politicians to “save” the Social Security trust fund. As of December 2025, the law remains stuck at 67. However, financial experts advise younger workers (Gen X and Millennials) to plan as if the age might increase in the future.

Conclusion: What Should You Do?

If you are healthy and still working, the best financial move in 2026 is often to wait. Check your my Social Security account online today. Look at the difference between your payout at 62 versus 67. That difference could cover your grocery bills for twenty years.

Retiring early is great, but retiring with a full wallet is even better.